how long can you go without paying property taxes in missouri

How long can you go without paying property taxes in Virginia. According to the Texas Comptrollers Office taxing units are required to give property owners at least 21 days after their original tax bills are mailed to pay the amount due.

Missouri Aarp Property Tax Aide

How long can property taxes go unpaid in Kansas.

. The type location and state laws would affect the property tax extension period. Unlike mortgages which you have to pay off within a specified duration property taxes go on forever. Property tax is usually paid in installments or at the end of the year.

Local legislation on the other hand may allow for a. However if the home has been sold on the third sale the. If youre late on your property taxes youll receive an additional penalty of 6 and start accruing 1 interest.

If property taxes are two calendar years in arrears the City can register a lien or Tax Arrears Certificate on title as per the Ontario Municipal Act 2001. Typically the period lasts one year in Missouri. In Missouri the period generally lasts.

If your property taxes are not paid by December 31 after the second anniversary of the due date a lawsuit in court seeking permission to sell the property may be filed by the city. Typically the period lasts one year in Missouri. If your tax bill is not.

If you do not redeem your tax credit within five. However if the home has been sold on the third sale the. How Long Can You Go.

How Long Can You Go Without Paying Property Taxes. Within one year after the sale and up until the deed is issued if it was sold at a first or second offering or within 90 days if. Length You Can Go Without Paying Property Taxes in Milwaukee In short you can go about two years without paying property taxes before the government sells your house to.

If you are late on your taxes you will be able to pay them in five years. The home sale tax exclusion is one of the more generous tax exclusion rules. Mainly the tax extension could be given to people that are underprivileged.

Vacant lots with petitioned specials are eligible for tax foreclosure sale after real estate taxes remain unpaid for 2 ½ years. What Happens When You Stop Paying Property Taxes in Texas. Up to 25 cash back Under Missouri law when you dont pay your property taxes the county collector is permitted to sell your home at a tax sale to pay the overdue taxes interest.

How Long Can You Go Without Paying Property Taxes In Missouri. Personal Property Tax Lookup Credit. When can you go without paying property taxes.

This exclusion lets you avoid paying taxes on the gains from a home sale up to 250000 or. According to the county this process lasts a different amount of time. Under a law passed in 1978 a state may sell a taxpayers property at public auction if the taxpayer fails to pay taxes within five years.

Property taxes are not required in Missouri to be paid in the amount of money specified by law. Up to 25 cash back In Missouri you can redeem the property. If you do not pay your property taxes by this.

Missouri property owners are reassessed every two years odd-year cycle. How long can you go without paying property taxes in Missouri. Under Virginia law if you cant afford to pay the entire overdue amount at once you can enter into an agreement to.

If the tax was included in your monthly mortgage payments and youve. How Long Can You Go Without Paying Property Taxes In Missouri Property taxes in Missouri are due on December 31st of each year. In most cases the redemption time ends two years from the date of the lien that is when other legal charges or taxes become liens.

How long can you go without paying property taxes in Missouri. Everyone is supposed to pay the property.

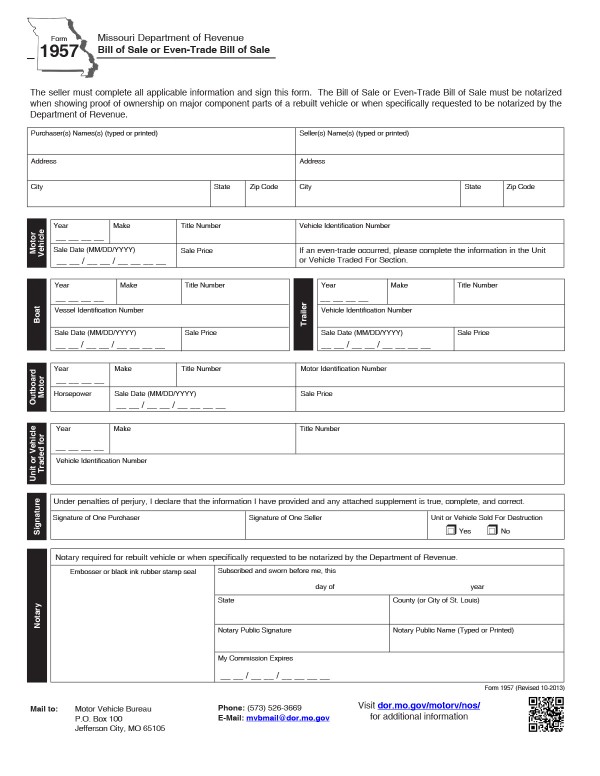

Missouri Bill Of Sale Form Templates For Autos Boats And More

Jackson County Mo Property Tax Calculator Smartasset

Missouri Adverse Possession Law

Gregory Fx Daly Gregoryfxdaly Twitter

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Secured Property Taxes Treasurer Tax Collector

Sales Use Tax Credit Inquiry Instructions

Personal Property Tax Jackson County Mo

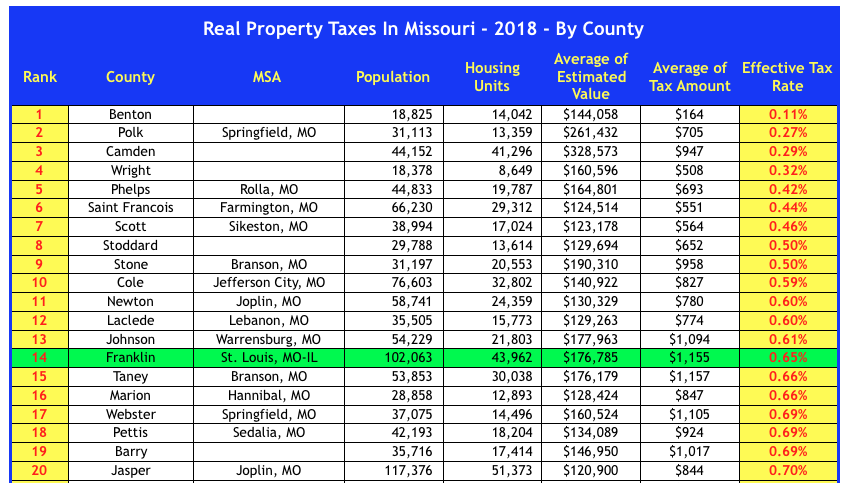

Missouri Property Taxes St Louis Real Estate News

Print Tax Receipts St Louis County Website

How To Buy Property For Back Taxes In Missouri

Clay County Missouri Tax A Resource Provided By The Collector And Assessor Of Clay County Missouri

What Happens If You Can T Pay Your Property Taxes

Deadline To Update Missouri Personal Property Taxes Approaches

Property Taxes Too High Here S How To Appeal Them And Lower Your Tax Bill Cbs News

Property Taxes How Much Are They In Different States Across The Us

/cloudfront-us-east-1.images.arcpublishing.com/gray/6LS33VXALREDDEYVTEGCCFGU54.jpg)